LinkedIn has been hard lately.

I’m sure you are seeing the same thing - post after post from friends and colleagues about layoffs. While the impact has been enormous in people terms, the scale has been hard to gauge. Are we over the hump? Is the snowball still rolling downhill?

So I decided to do some research. I built a list of 200 B2B SaaS companies that:

- Had 100+ employees

- Took venture funding since 2018

and - Are HQ’d in the US or Canada

I then used the amazing crowdsourced resources of layoff.fyi’s tracker and Candor’s hiring/freezing/layoff data to track which companies are still hiring, which have frozen hiring, or which have done layoffs. Here’s what I found.

Point 1: Funded B2B SaaS was hit hard

From our broader B2B tech data, we know that roughly 30% of companies laid off AEs through late April. For my VC-backed SaaS sample, that number is 41% with another 18% having frozen hiring.

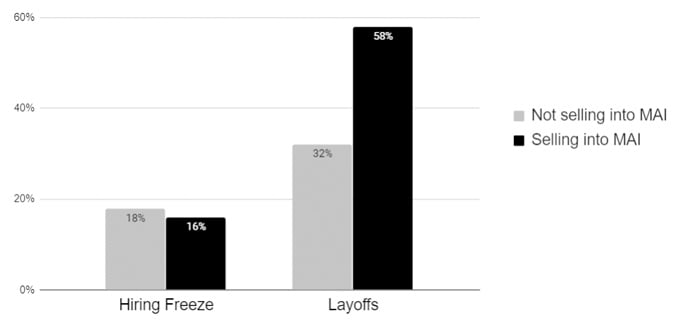

Those selling into Massively Affected Industries (MAI) were the hardest hit. We define MAI as advertising, hospitality, HR & recruiting, live events, medical practices, real estate, travel, and so on.

58% of SaaS companies selling into MAIs have laid off employees. That is staggering for a period of just 7 weeks.

Point 2: The worst appears to be over.

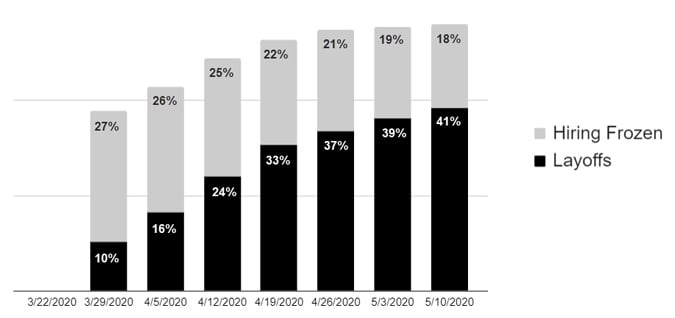

The week of 3/29 was brutal. 69 companies took action that week - 19 with layoffs and another 50 froze hiring.

From there, I note an acceleration as additional companies froze hiring and many transitioned from hiring freezes to layoffs. But that trend peaked the week of 4/26.

For the last 2-3 weeks, the pace of layoffs has slowed significantly. Let’s hope the worst is over

Point 3: Hiring is ramping back up

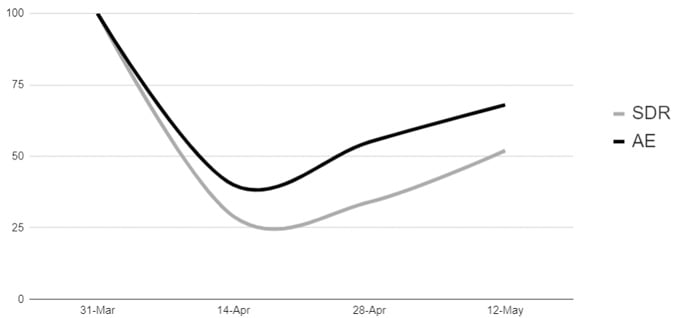

Using LinkedIn Jobs, Indeed, and Glassdoor, I took snapshots of open SDR and AE positions on 3/31, 4/14, 4/28, and 5/12.

There was a massive(!) decline in new posts from mid-March to mid-April. Newly posted jobs fell on the order of 65%. The chart below shows new posts per week indexed to March 31st across Austin, Boston, Chicago, NYC, and San Francisco.

After the initial freeze, we’ve seen a rebound. This is similar to broader US job posting data coming out of the Indeed Hiring Lab.

Note that new posts for SDR positions fell farther and have rebounded slower than those for AEs.

Point 4: Competition for open positions is off the charts

On March 31st, I captured applicants per LinkedIn Job post. In this pre-COVID period, the data show:

- SDR position: median 17 applicants per month

- AE position: median 9 applicants per month

I then captured the same data on 4/30 and found:

- SDR position: median 72 applicants per day

- AE position: median 37 applicants per day

Applicants per open position have increased exponentially. From 9-17 per month to 37-72 PER DAY.

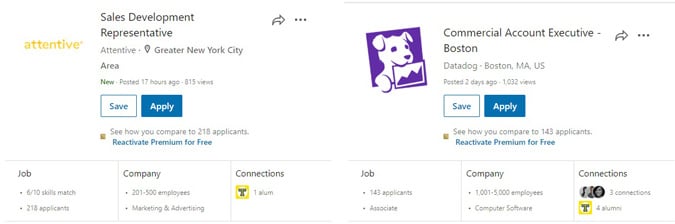

Below are two sample job posts from earlier this week. Note the hours since posting, views, and applicants - 17 hours, 815 views, and 218 applicants | 2 days, 1032 views, and 143 applicants. Wild.

TL;DR

In summary…

- Funded B2B SaaS companies moved quickly with hiring freezes and layoffs. For my VC-backed SaaS sample, that number is 41% with another 18% having frozen hiring.

- The worst appears to be over. The week of 3/29 was brutal. But the wave of layoffs peaked the week of 4/26.

- Hiring is ramping back up. New postings for SDR and AE openings fell off a cliff in early April. Companies are hiring again with a steady rebound over the last four weeks.

- Competition for open positions is off the charts. An SDR position posted on LinkedIn Jobs would get a median of 17 applicants a month pre-COVID. Today, the median number of applicants is 72 per day.