What a year April 2020 was.

Record breaking unemployment news, record setting fiscal and monetary reaction, positive (?), and ever-changing epidemiological models make it hard to trust the ground underfoot.

We wanted to quantify the evolving impact on the B2B tech space so together with RevOps Squared, we surveyed 110+ revenue leaders. We asked:

- What actions they have already taken

- Future actions they are considering

and - Their outlook for the remainder of calendar 2020

Finding 1: Roughly 30% of leaders report reducing the number of AEs

(Note this data is as of April 24th) The median reduction was 40% - a huge number! A further 35% report concern over possible future reductions.

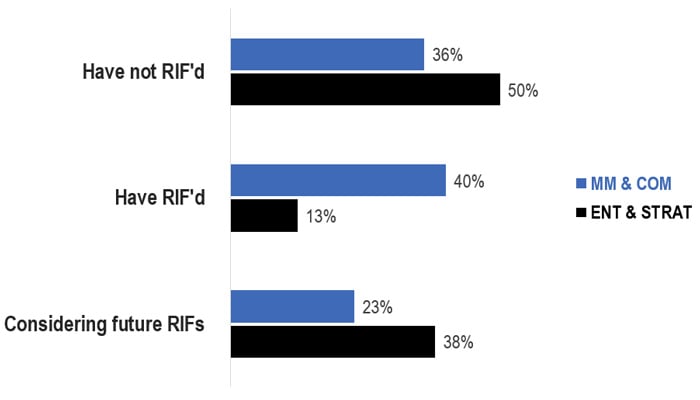

We found no significant correlation between company size (ARR) nor selling price (ACV) and the decision to lay off AEs. We note that companies selling into Midmarket and Commercial segments ($10M-$1B) were much more likely to RIF than companies selling into Enterprise and Strategic ($1B+).

Finding 2: One-third report reducing 2020 AE quota

This varies sharply between those companies that have/have not done a reduction in force.

- Of those that have laid off AEs, 60% reduced quotas

- Of those that have not, 24% reduced quotas

The median quota reduction is 35% - with 25%-50% being the 25th and 75th percentile bounds.

For those that haven’t reduced quota, nearly one-third have reduced non-quota metrics like activities, discovery calls, new pipeline, and so on.

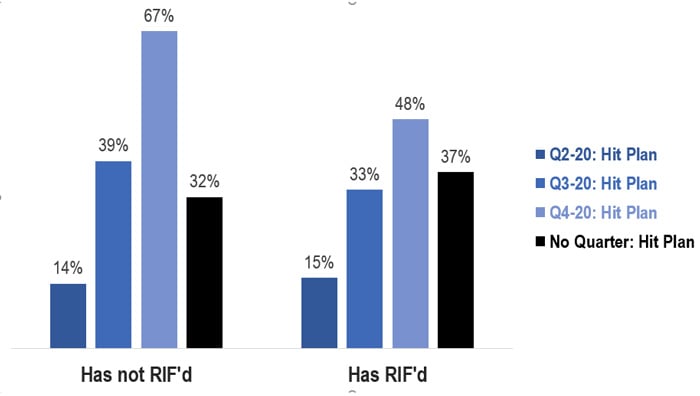

Finding 3: Optimism for 2020 is mixed

We asked which quarters leaders believe they might hit pre-COVID 2020 plans.

As you can see, few are optimistic about Q2. Optimism improves for Q3 and a majority believe they’ll hit Q4. But nearly one-third aren’t confident in hitting any target in 2020.

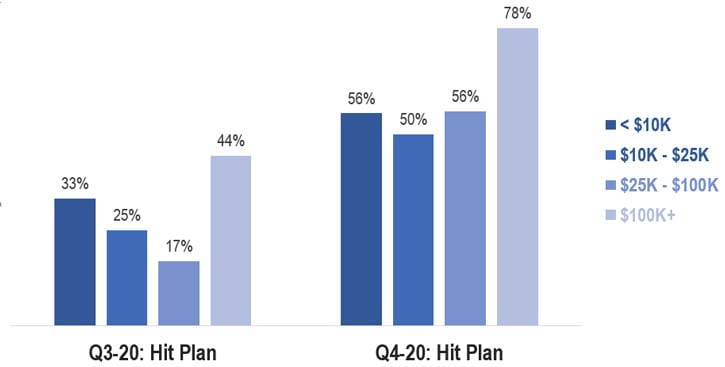

Controlling for all other factors, high-ACV companies are the most optimistic. Companies with $100K+ ACVs are significantly more optimistic about Q3 and Q4.

There’s more to come

We plan on repeating this research regularly. We’re hoping to detect and share changes in optimism as they emerge. You can get the full report (un-gated PDF) here.

I’m also nearly finished another research project looking at hiring freezes, layoffs, and the return to hiring for funded B2B SaaS. Hoping to drop that piece next week.

Stay safe and stay sane out there.