We’ve just released the 2020 SaaS AE Metrics Report. This marks the 7th round of this research project. Leaders from 287 SaaS companies shared their key metrics--growth rate, ACV, model, quota, comp, tech stack, and more.

You can get a full copy of the report here, but I wanted to share one finding that really stuck out.

AE comp soars to new highs

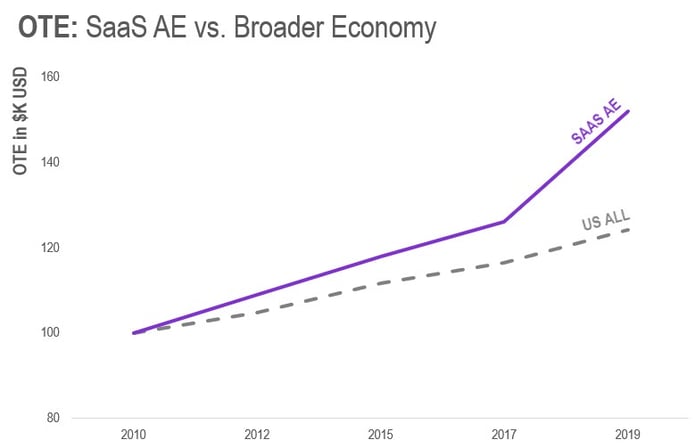

Last year, I wrote about SaaS AE compensation continuing to outpace the broader US economy.

That’s a 52% increase since 2010 (~5% compounded annually). Compare that to SDR compensation, which has been flat since 2010 when adjusting for inflation.

In this report, we find median SaaS AE on-target earnings of $158K. More than 70% of respondents report OTEs in excess of $120K. Wow.

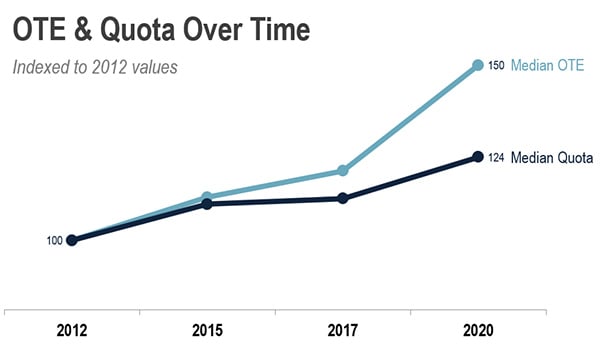

Quotas are rising, but not at quickly

Median ACV quota rose from $625K in 2012 to $775K in 2020. This represents a compound annual growth rate of 3%. Clearly there is a divergence between productivity and compensation.

Dale Chang, Operating Partner at Scale Venture Partners, recently shared his thoughts on if the sales model is sustainable.

Quota levels need to align with a company’s operating model, especially when Sales & Marketing often represents more than 50% of total Operating Expenses.

Sales efficiency measures a company’s return on Sales & Marketing spend. It’s an incredibly useful metric that investors and companies alike use to gauge the effectiveness of a particular sales model.

With a tight labor market and fierce competition for talent, it seems unlikely this trend will reverse any time soon.