In some ways, more has changed in the last two years than in the previous ten.

In our just released 2023 SDR Metrics & Compensation Report, we analyze the shifts in sales development over this period. Which trends have accelerated? Which strategies have withered? We dig into areas like motion, model, ramp, tenure, attrition, activity, compensation, tech stack, and front-line leadership.

About the Participants

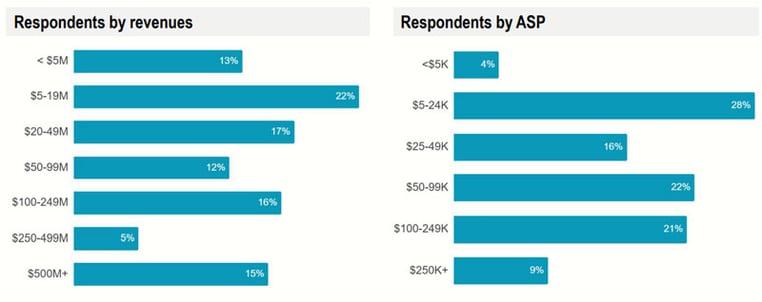

This is our ninth round of this biennial research project and I can tell you it's our best one yet. This year, 365 Executives from a broad range of B2B companies participated. (69% North America companies, another 21% with global footprints, median respondent revenues of $45M, and median ASP/ACV at $52K).

A few observations

Before we began the number crunching, we collected a list of hunches on what we’d find. In the interest of transparency, we decided to share what we hypothesized and what we found.

- The shift from office-first to work-from-anywhere was swift, pervasive, and persistent (pages 14-15)

- Average experience, ramp, and tenure are changing the math of the SDR role (pages 17-21)

- Layoffs following rate hikes have shifted the power dynamic in the SDR hiring market (pages 24-25)

- A changing B2B buyer requires SDRs to change in turn (pages 26-29)

- It is time to revisit the assumptions behind your qualification criteria, quotas, and pipeline contribution metrics (pages 32-34)

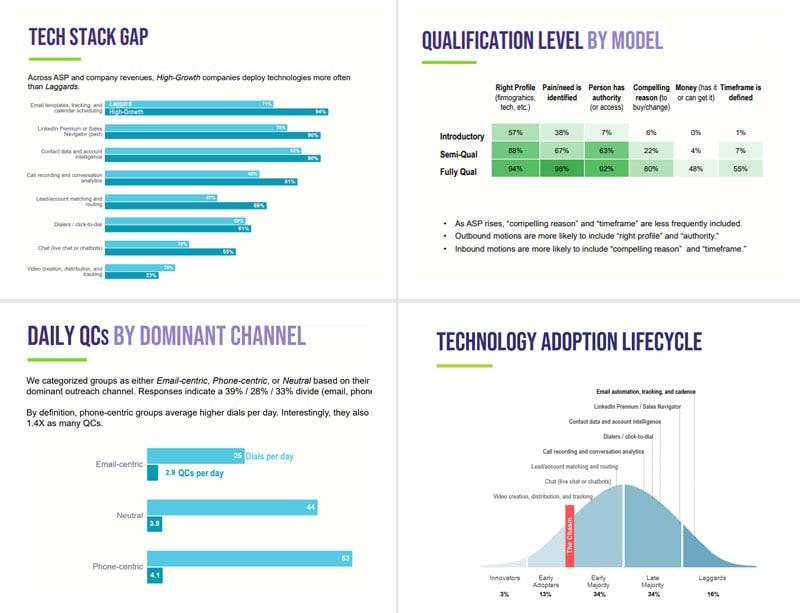

- Some tech are at the vanguard and some table stakes (pages 38-41)

- In this high-inflation environment, how have SDR and Leadership compensation reacted (pages 36, 37, 45, 46)

Get the full report

The report provides a comprehensive look at the data, trends, and metrics driving sales development in 2023. We couldn't do these types of research reports without this community. So thank you.

Get your copy of our Sales Development Metrics & Compensation research and let us know if you have any comments, questions, or improvements for the next round.