UPDATE: The 2023 Sales Development Metrics Report is published and available for download.

For obvious reasons, 2020 will be remembered for COVID-19.

While some implications already seem apparent (hanging out slacking on teamed zooms, remote work, inside selling), many will take time to become perceptible.

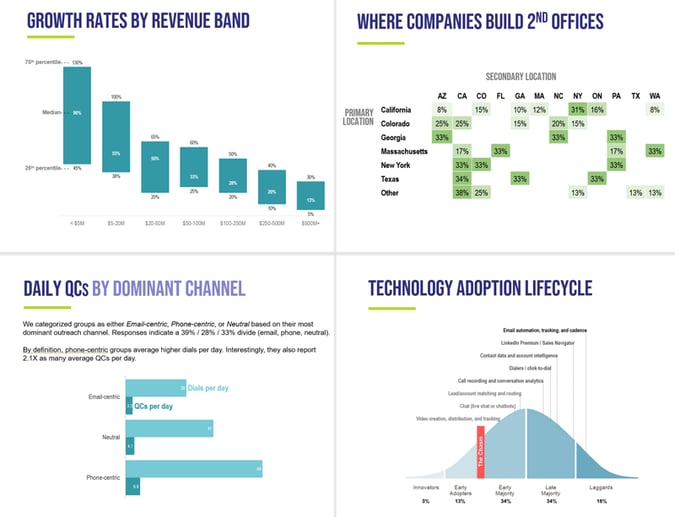

In our just released 2021 SDR Metrics & Compensation Report, we analyze the shifts in sales development over recent years and which trends have accelerated. We dig into areas like motion, model, ramp, promotions, attrition, activity, comp, tech stack, and front-line leadership.

About the Participants

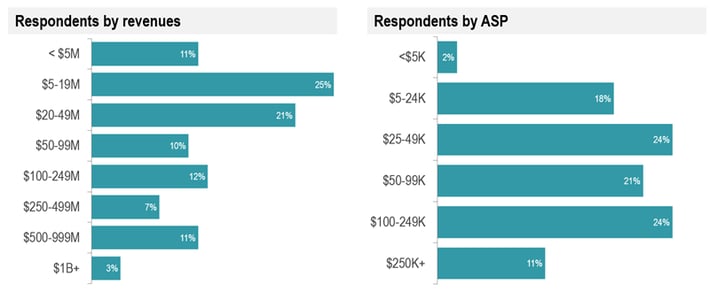

This is our eighth round of this research project and I can tell you it's our best one yet. This year, 406 Executives from a broad range of B2B companies participated. (91% with HQs in North America, median respondent revenues of $35M, and median ASP/ACV at $55K).

A few observations

Before we began the number crunching, we collected a list of hunches on what we’d find. In the interest of transparency, we decided to share what we hypothesized and what we found.

- Labor market shocks will lead managers upstream for more senior candidates ❌ (pages 18-19)

- Average tenure will rise as quits and internal promotions slow ✔️ (pages 21 & 25)

- Effort per QC / meeting / Oppty will rise as the economy contracts ✔️ (pages 28-30)

- Qualification criteria will soften ✔️ (see pages 31-32)

- Despite softened qualification criteria, average attainment will fall ❌ (pages 33-34)

- Companies will pare back tech stacks to save money & lower complexity ❌ (pages 40-42)

- SDR groups will rebound quickly (if unevenly) from RIFs ✔️ (pages 51-52)

Get the full report

The report provides a comprehensive look at the data, trends, and metrics driving sales development in 2021. We couldn't do these types of research without this community. So thank you.

Get your copy of our Sales Development Metrics & Compensation research and let us know if you have any comments, questions, or improvements for the next round.