We’ve been closely following the B2B tech hiring market over the last twelve months. And with the Bureau Labor Statistics releasing the new Job Openings and Labor Turnover Summary (JOLTS) last week, I thought now was a good time to take stock.

Compared to the trough (mid 2020) things are massively improved. But compared to the peak (late 2019) we aren’t yet fully recovered. Here are four things I’m seeing:

1) Layoffs are well behind us

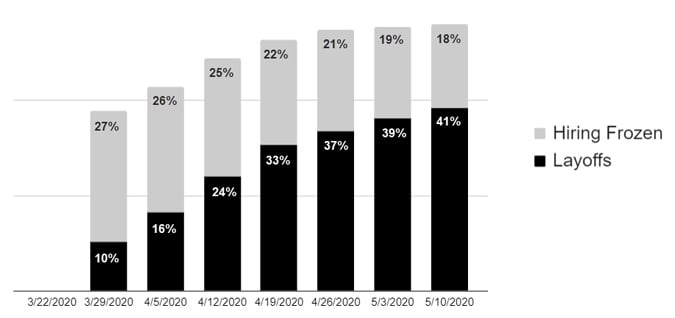

Back in May 2020, I looked at 200 funded B2B SaaS companies and found:

- Hiring freezes roared into April and turned to layoffs by May

- By the middle of Q2 2020, 40%+ of companies had laid off SDRs, AEs, and AMs

- Job losses peaked in late Q3

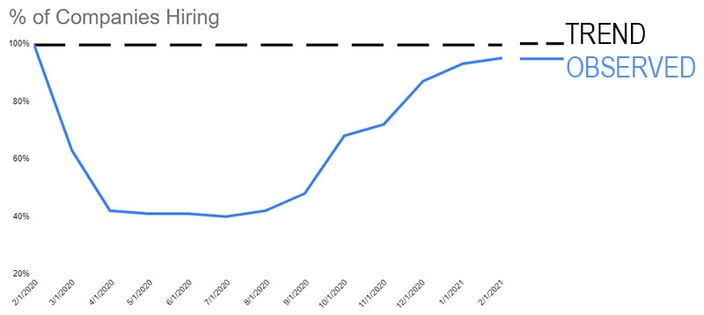

2) Hiring has surged back

Taking a look at those same 200 companies (excluding those that were M&A’d out of existence), I found hiring restarted in October and the recovery has only accelerated since.

Admittedly this is a binary view as I’m lumping Company A hiring 2 SDRs and Company B hiring 20 into the same camp. Further, I can’t tell if Company C hired 14 SDRs in 2019 and plans to hire just 4 in 2021. Still, interesting data.

Next I turned to broader employment numbers.

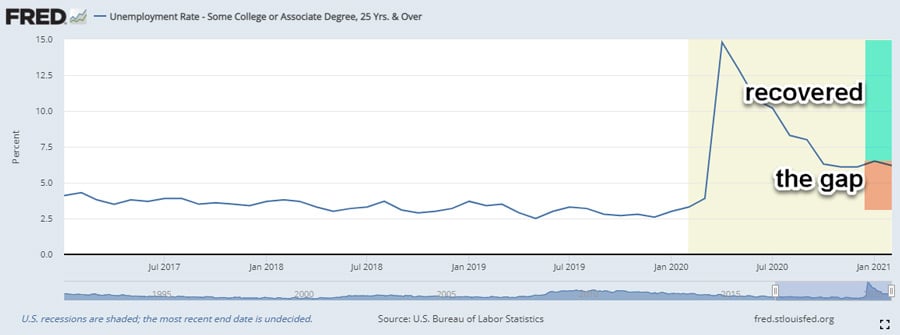

3) Sales employment has recovered 75% of the losses

Obviously there isn’t a category for SDR/AE/AM candidates in the unemployment data. But I’ve relied on “Some College and Associate Degree, 25 Yrs. & Over” as a fair enough proxy.

Through most of 2019, the unemployment rate hovered around 2.8%. That’s a level not seen since the boom years of 1998-2000. Then, seemingly overnight, the unemployment rate shot up to 14.8%.

We’ve since recovered nearly 75% of the losses. The unemployment rate for Some College or Associate's Degree, 25yrs+ now stands at 6.2% - bringing us back to the job market of the mid-2010s.

For the final piece of the puzzle I turned to the JOLTS report.

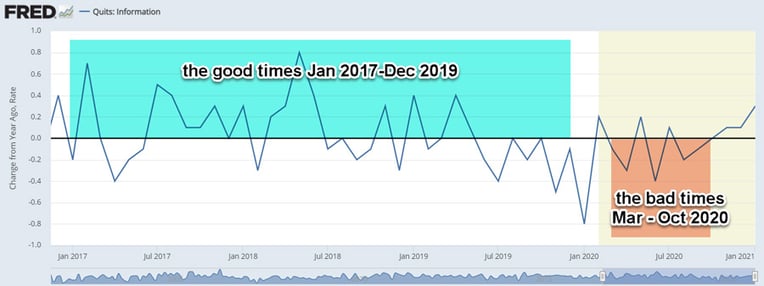

4) Quits are accelerating

The latest JOLTS release covers January 2021. Quits, or voluntary separations, are particularly of interest. The rate of quits is a good indicator of the strength of the labor market as it tends to fall sharply in recessions and rise in expansions.

I use the “Information” category as the best proxy for B2B tech. The chart below shows the monthly change from one year ago in the Information quit rate. Above the line shows an increasing rate of quits year-over-year and below the line the reverse.

Last week's JOLTs data show an increase in quits for three straight months. This is good news for reps looking to make a change and something to keep on eye on for sales leaders.

Net Net

Heading into April 2021, we are in a much better place than we were in April 2020. Layoffs are in the rear-view, companies are hiring, employment is recovering, and quits are accelerating.

That being said, we still have roughly 1.8 unemployed workers for every job opening in our industry. That is nearly double where we were in the middle of 2019.

I don’t have any big meta-conclusion to share. So do with this what you will. : )