I think I’m starting to understand why the phrase “may you live in interesting times” is considered a curse.

A global health crisis, an unscripted pivot to work from home, and an accompanying economic fallout--times are certainly interesting.

If you’re like me, you're keenly interested in what this all means for outbound prospecting today and tomorrow. One of the best sources of real-time data is Chris Beall, CEO of conversations on demand company ConnectAndSell. He is (and has been for years) sharing data on dials, conversations, and meetings.

Earlier this week, he shared their “top couple hundred customers' results since mid-Feb 2020.” I’ve taken the liberty of charting out the data.

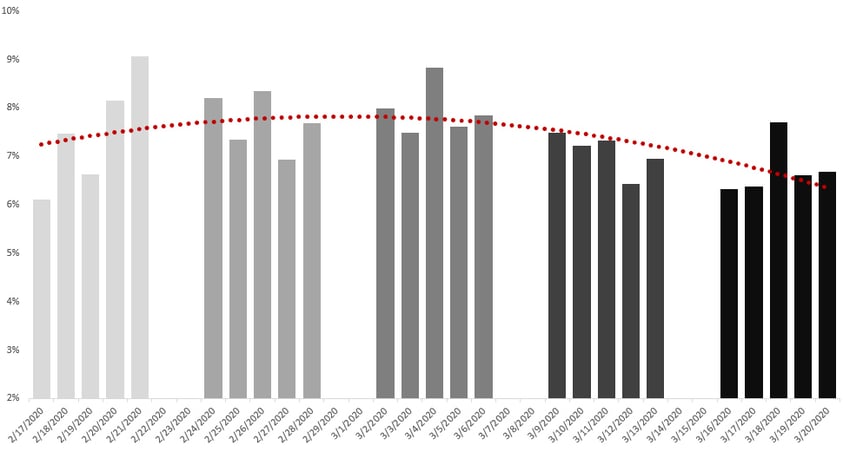

Conversation to Booked Meeting Rate

I note an 11% decline for the week of March 9th followed by an additional 4% decline for the week of March 16th. That’s only a 14% decline in meetings booked since mid-February. That is much, much better than I would have predicted.

But Chris said these are his top customers.

So I dug deeper.

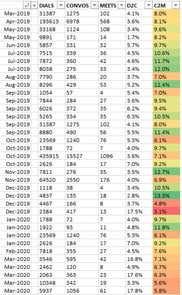

I went back through 12 months of data shared by Chris to build out another data set. (Note: D2C is Dial-to-Conversation and C2M is Conversation-to-Meeting.)

I went back through 12 months of data shared by Chris to build out another data set. (Note: D2C is Dial-to-Conversation and C2M is Conversation-to-Meeting.)

The first thing to notice is just how much results vary week over week. August 2019 for example reported both a 7% and a 12% meeting rate. I used a three data point moving average and found:

Overall, results are down sharply. The Conversation-to-Meeting Rate is down 32% year over year.

That is worse than the top performer data, but isn’t a halving. And it certainly isn’t a decimation. Reps who are still on the phone are still booking meetings.

So the big questions are: How much of this is the business climate? How much is the transition to work from home?

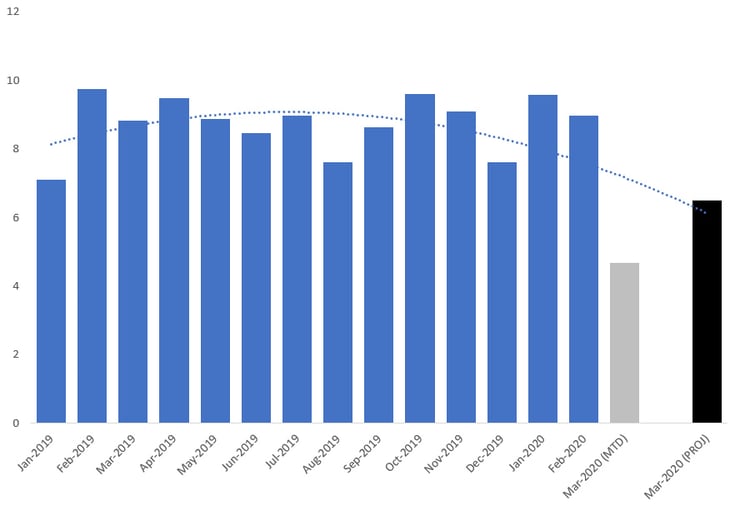

A kind reader shared their team data with us. The company has 35+ SDRs who were already fully remote. So any change in performance can be attributed to social, mental, economic factors and not to a shift from office to WFH.

Meetings per SDR

by month-year

We notice a similar trajectory between this data and ConnectAndSell’s, namely:

Meetings per SDR are down 24% year over year.

So where does this leave us?

SDR results are and will continue to be impacted. But the degree will vary widely from team to team. Our best guesses based on these data are in the following ranges:

- Impact of transition to WFH: -15% to -10%

Until we settle into a new routine

- Impact of demand shock: -30% to -15%

Until a new normal takes root

- Impact if selling to massively affected industries: -65% to -45%

Until social distancing is no longer required

I hope this data helps you. Stay safe and stay sane out there.